Lifestyle

Silver Prices Surge to Record Highs, Surpassing Gold

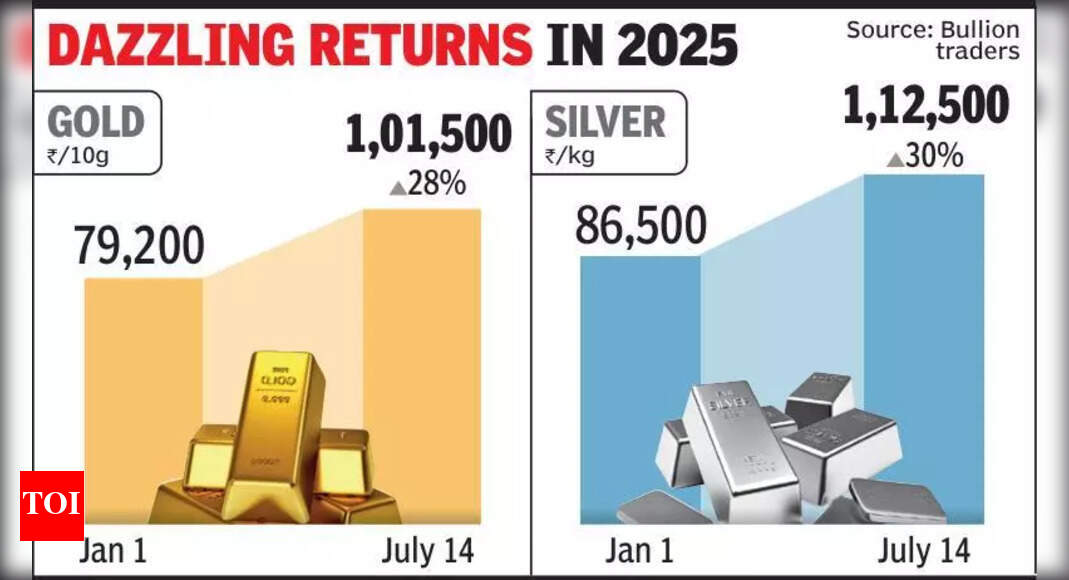

The price of silver has reached an unprecedented level, now trading at $1,120 per kilogram, surpassing the price of gold for the first time in several years. This significant shift in the precious metals market has drawn the attention of investors and analysts alike, marking a notable moment in commodity trading.

Market Dynamics and Investor Reactions

The rise in silver prices can be attributed to several factors, including increasing industrial demand and heightened interest from investors seeking safe-haven assets. As economic uncertainties loom, silver has emerged as a viable alternative to gold, traditionally viewed as the go-to investment during turbulent times.

In October 2023, analysts noted a surge in purchases of silver, driven by its applications in renewable energy and technology sectors. Industries such as solar energy and electric vehicle production have contributed to a spike in demand, making silver a critical component in modern manufacturing.

Investor sentiment has shifted significantly. Many are now viewing silver as not only a precious metal but also a strategic asset. This change has led to increased trading volumes and speculation about the future trajectory of silver prices.

Comparative Analysis with Gold

Historically, gold has dominated the precious metals market, often commanding higher prices due to its established status as a store of value. However, the recent surge in silver has raised questions about the ongoing relevance of gold in an evolving economic landscape.

At $1,120 per kilogram, silver now competes closely with gold, which has faced its own market fluctuations. Investors are increasingly analyzing the benefits of diversifying their portfolios with silver, particularly as its industrial applications continue to expand.

Industry experts are closely monitoring this shift. According to the World Silver Survey, the demand for silver is projected to grow, potentially leading to sustained higher prices in the coming months.

The implications of silver’s rise are multifaceted, impacting not just investors but also the broader economy. As the demand for sustainable technologies increases, silver’s role as a key material could solidify its status in the global market.

In conclusion, the recent spike in silver prices represents a notable shift in the precious metals landscape. With silver now trading at an all-time high of $1,120 per kilogram, its competitive position against gold signals changing dynamics in investor behavior and market demands. As this trend continues to unfold, stakeholders across various sectors will need to adapt to the implications of this emerging reality.

-

World7 months ago

World7 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle7 months ago

Lifestyle7 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science6 months ago

Science6 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World7 months ago

World7 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories7 months ago

Top Stories7 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Science7 months ago

Science7 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Sports6 months ago

Sports6 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Top Stories7 months ago

Top Stories7 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business7 months ago

Business7 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports6 months ago

Sports6 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics7 months ago

Politics7 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories7 months ago

Top Stories7 months agoPatna Bank Manager Abhishek Varun Found Dead in Well