World

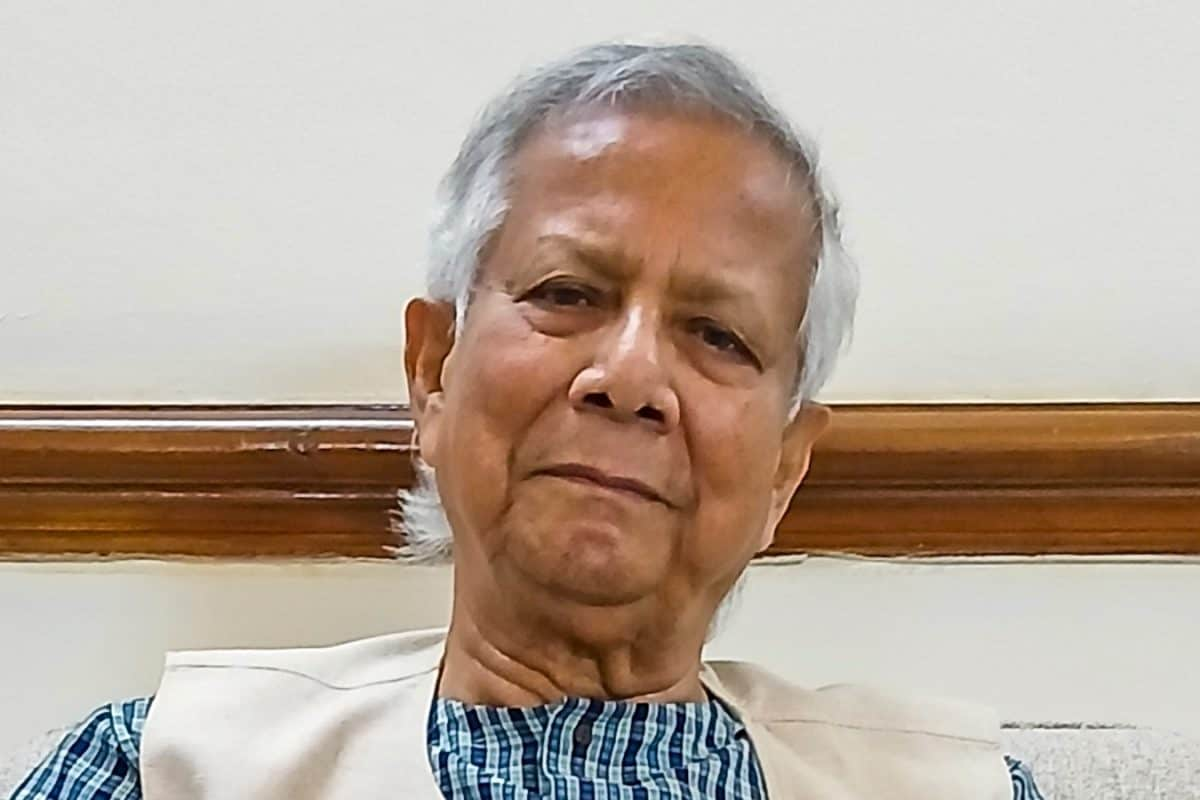

Exiled Officer Claims Muhammad Yunus Misappropriated Microcredit Model

Explosive allegations have emerged from former Bangladeshi intelligence officer Aminul Hoque Polash, who claims that Muhammad Yunus, the Nobel laureate credited with pioneering microcredit, misappropriated a university research project for personal benefit. Polash, now in exile, has released internal documents dating from 1976 to 1983 that he asserts fundamentally challenge the established narrative surrounding the origins of microcredit.

The documents suggest that the true foundation of microcredit can be traced back to the Rural Economics Programme (REP), initiated at Chittagong University with funding from the Ford Foundation. Polash argues that Yunus’s involvement in the program was limited and that he did not play a central role in the groundbreaking micro-lending initiatives that began in Jobra village, which is widely recognized as the birthplace of microcredit.

According to Polash, the micro-lending experiment was primarily conducted by junior researchers, including Swapan Adnan, Nasiruddin, and H.I. Latifee. He contends that Yunus was originally tasked with managing tubewell cooperatives, thereby positioning him outside the core team responsible for micro-lending.

The documents also allege that the concept of rural credit was officially adopted as a national model by the Bangladesh Bank during a meeting in 1978, where Tk 100 crore was allocated for a nationwide rollout through state banks. This initiative, later named the “Grameen Bank Project,” indicates that the state had already recognized and initiated the concept before Yunus gained complete control. Furthermore, a significant letter from the Ford Foundation in 1983 reportedly confirms that the grant was directed to the university, rather than to Yunus himself.

Polash recounts how Yunus ascended to the position of Project Director, ultimately becoming the Managing Director of Grameen Bank following the 1983 Grameen Bank Ordinance. By the 1990s, what had begun as a publicly funded research initiative evolved into a vast global enterprise under Yunus’s leadership.

The allegations extend beyond historical claims, as Polash suggests that Yunus’s influence has now infiltrated governmental operations. Since becoming Chief Advisor in August 2024, Yunus is accused of using state resources to erase his legal troubles and benefit his affiliated companies. In a mere 15 months, he reportedly had a previous prison sentence overturned, five labor cases dismissed, and corruption allegations withdrawn by the Anti-Corruption Commission (ACC) and courts.

Additionally, Grameen enterprises are said to have received substantial financial advantages, including the cancellation of a Tk 666 crore tax liability for Grameen Kalyan and a five-year tax exemption for Grameen Bank. Exclusive licenses were granted to various Grameen entities, such as a digital wallet license to Grameen Telecom and a manpower export license to Grameen Employment Services, alongside efforts to reduce the government’s stake in Grameen Bank.

Polash stresses that it is vital to move beyond the myth of Yunus as the sole inventor of microcredit. He warns that the same pattern of “institutional capture” observed in the past is now repeated at the highest levels of government.

The release of these documents has reignited discussions about the origins of microcredit and the implications of Yunus’s governance in Bangladesh. As the narrative unfolds, the international community watches closely, given the significant influence of Yunus and the Grameen model on global microfinance initiatives.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well