Business

PhysicsWallah Files for ₹3,820 Crore IPO Amid Safety Concerns

PhysicsWallah Ltd., one of India’s leading edtech platforms, has submitted an updated draft red herring prospectus (DRHP) to the Securities and Exchange Board of India for an initial public offering (IPO) valued at ₹3,820 crore. The filing not only outlines the company’s financial performance and market competition but also raises significant concerns regarding student safety incidents in its offline learning centres.

Among the unusual risk factors identified in the filing are various safety incidents involving students. These incidents range from harassment complaints to bizarre disruptions within the learning environment. In a troubling episode from 2023, a student allegedly threatened a faculty member with a slipper during a video call. Additionally, a staff member was filmed pushing a student at an offline centre, a video that quickly circulated online, leading to the staff member’s termination following an internal inquiry.

Another incident mentioned in the prospectus involved a ceiling fan falling on a student at a centre in New Delhi. Although this matter has been resolved, it underscores the potential risks associated with the physical learning environments provided by PhysicsWallah. The company acknowledged that while it has implemented measures to enhance student safety, such measures cannot completely eliminate the risk of future incidents. This has raised concerns about the potential impact on the company’s reputation, business operations, and financial health.

Founded in 2016 as a YouTube channel, PhysicsWallah has evolved into a comprehensive education provider catering to a variety of academic needs. The company offers services spanning K-12 education, NEET, JEE, UPSC, and state-level competitive exams, alongside initiatives in study abroad programs, degree offerings, and upskilling, serving over 2 million students annually across Tier-II and Tier-III cities in India.

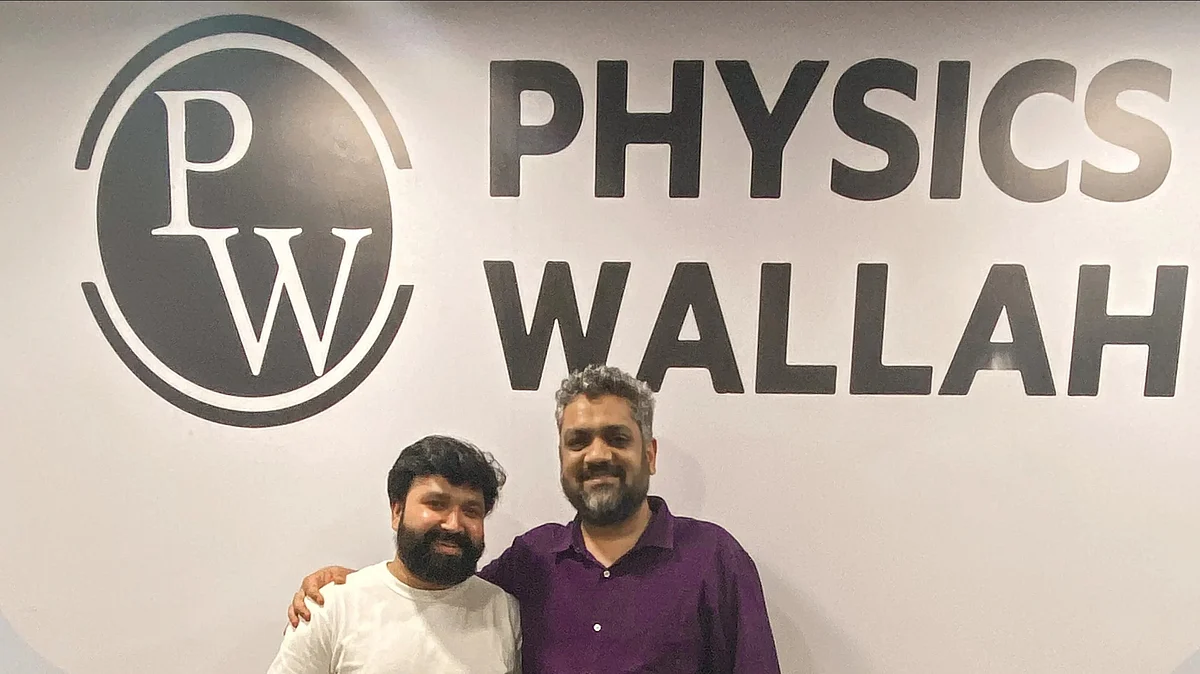

The company remains co-founded by Alakh Pandey and Prateek Maheshwari, who each hold approximately 40.35% of the firm, representing over a billion shares apiece. These co-founders have played a pivotal role in PhysicsWallah’s growth trajectory.

In its financial report for FY25, PhysicsWallah reported total income of ₹2,886 crore, a significant increase from ₹1,940 crore in FY24 and ₹744 crore in FY23. The company has also made strides in reducing net losses, which narrowed to ₹240 crore in FY25, down from ₹1,127 crore in FY24 and ₹85 crore in FY23.

A considerable portion of PhysicsWallah’s revenue is generated from offline centres located in major cities, including the National Capital Region, Patna, Kota, Kozhikode, Lucknow, and Kolkata. The firm has appointed leading financial institutions—Kotak, JP Morgan, Goldman Sachs, and Axis Capital—as book-running lead managers for the upcoming IPO.

As PhysicsWallah prepares for this significant public offering, the highlighted safety concerns will likely attract scrutiny from potential investors and the public alike. The company’s ability to address these issues effectively will be crucial as it moves forward in its mission to provide quality education.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well