Business

Government Confirms No Proposal to Raise FDI Limit in PSU Banks

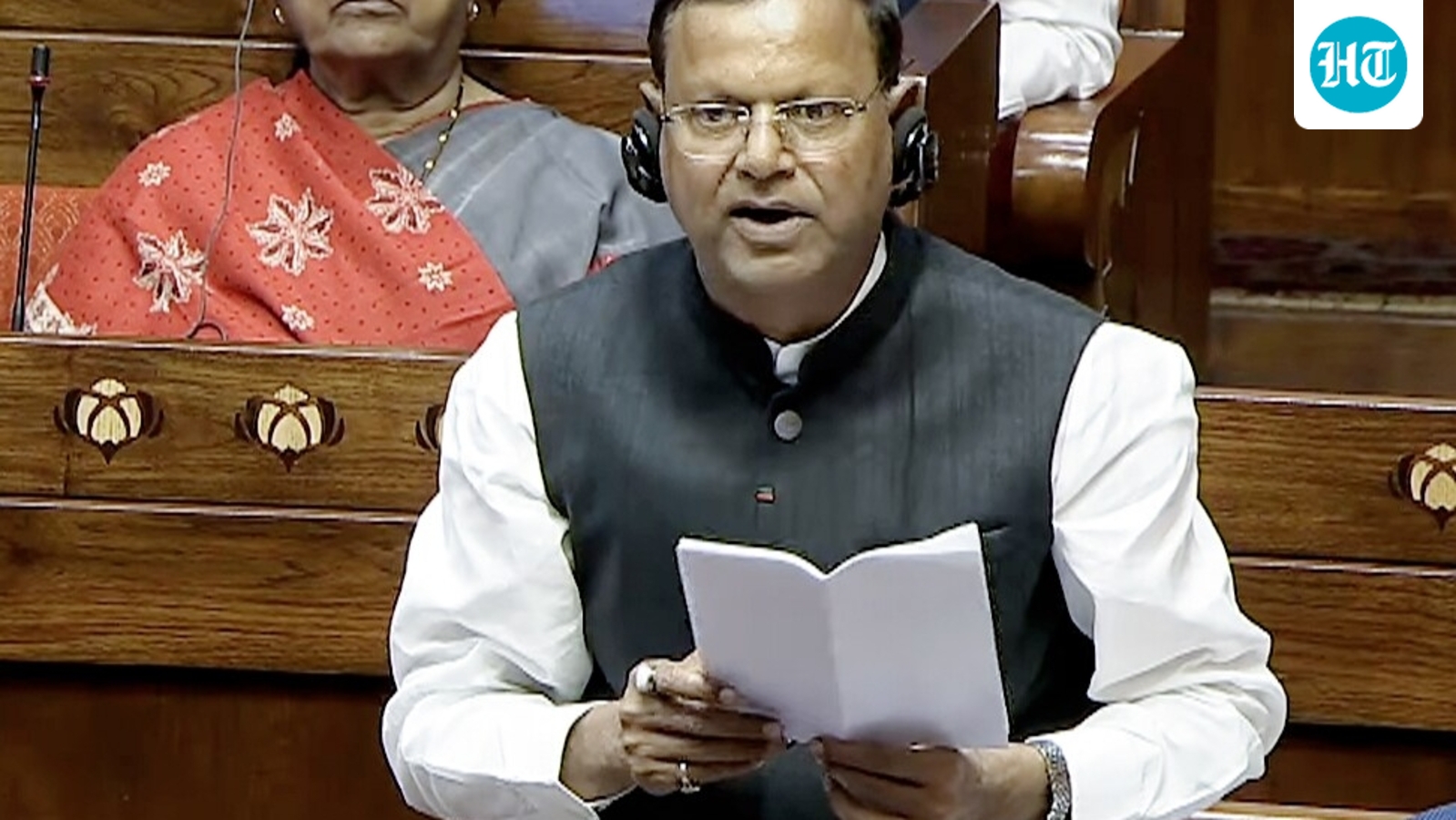

Public sector bank stocks experienced a decline following a statement from the government confirming that there are no current plans to increase the foreign direct investment (FDI) limit in these banks. During a session in Parliament on Tuesday, Pankaj Chaudhary, the Minister of State for Finance, addressed a query regarding the potential increase of the FDI limit from the current 20% to 49%. He categorically stated that the government is not considering such a proposal.

In response to a written question posed in the Rajya Sabha, Chaudhary emphasized that the government has no plans to raise the FDI limit for public sector banks. He noted that, as per the Reserve Bank of India (RBI) guidelines, any investor looking to increase their stake beyond 5% in a public sector bank must obtain prior approval from the RBI. Additionally, banks are required to adhere to the Securities and Exchange Board of India (SEBI) regulation mandating a minimum public shareholding of 25%.

At present, the government allows FDI of up to 20% in public sector banks, while private banks can receive up to 49% through the automatic route and up to 74% with government and central bank regulatory approvals. This regulatory framework is designed to ensure stability and compliance within the banking sector.

Chaudhary further clarified that while the government’s overall share in India’s 12 public sector banks has not diminished since 2020, the percentage of its stake may appear lower due to various fundraising initiatives undertaken by these banks. He explained that capital raising efforts are essential for business growth and for meeting regulatory requirements. Such actions not only alleviate the fiscal burden on the government but also help strengthen the banks’ balance sheets.

The government’s position on the FDI limit reflects a cautious approach towards foreign investment in critical sectors such as banking. As the financial landscape evolves, the implications of this policy on both public and private sector banks will continue to be closely monitored by investors and market analysts.

With inputs from PTI.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well