Top Stories

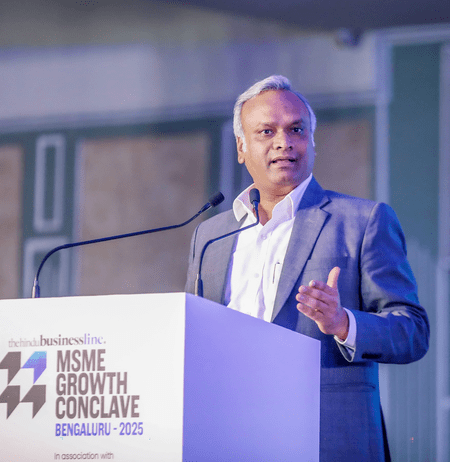

Karnataka Minister Critiques GST Overhaul for Burdening Citizens

Karnataka’s Minister for Rural Development and Panchayat Raj, Priyank Kharge, has expressed strong disapproval of the recent overhaul of the Goods and Services Tax (GST) by the central government. Speaking on September 4, Kharge highlighted that the revised GST framework continues to impose a significant financial burden on the poor and middle class, while offering relief to corporations and wealthy individuals.

Kharge pointed out that a staggering 64 percent of total GST revenue is collected from the pockets of the lower and middle-income groups. In contrast, he noted that only 3 percent of the GST is sourced from billionaires. Additionally, he referenced a significant reduction in corporate tax rates, which have decreased from 30 percent to 22 percent, raising concerns about fairness in the tax system.

Concerns Over Revenue Compensation

While Kharge acknowledged that the government has taken steps toward rationalising and simplifying the GST, he questioned how states like Karnataka would be compensated for potential revenue losses resulting from these changes. He took to the social media platform X, describing the reform as long overdue and advocating for a more equitable tax structure.

“The government’s approach to the ‘Gabbar Singh Tax’ has finally shown signs of common sense,” Kharge stated. He referenced the Congress party’s longstanding demand for a simplified GST system. He pointed out that the original intent of “One Nation, One Tax” has devolved into an unwieldy structure with multiple tax rates, including 0 percent, 5 percent, 12 percent, 18 percent, and 28 percent, as well as special rates of 0.25 percent, 1.5 percent, 3 percent, and 6 percent.

Kharge also reminded the public that Congress leaders, including Rahul Gandhi and Mallikarjun Kharge, have been vocal proponents of capping GST at 18 percent and rationalising the tax to ease the burden on micro, small, and medium enterprises (MSMEs) and small businesses. The party has included proposals for “GST 2.0” in its manifestos for both the 2019 and 2024 elections, which aim to simplify compliance for these businesses.

Impact on Farmers and Essential Commodities

In his critique, Kharge pointed out that the burden of taxation extends even to farmers, with at least 36 agricultural items now subjected to GST rates ranging from 12 percent to 28 percent. He highlighted the unfairness of taxing essential commodities, including packaged milk, wheat flour, curd, books, and stationery.

This criticism reflects broader concerns regarding the implications of fiscal policies on the most vulnerable segments of society. As the government moves forward with its GST reforms, the discussion around equitable tax structures and fair compensation for states is likely to continue, with leaders like Kharge pushing for reforms that prioritize the needs of ordinary citizens over corporate interests.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well