Sports

WhistlinDiesel Arrested for Tax Evasion Over $30,000 Debt

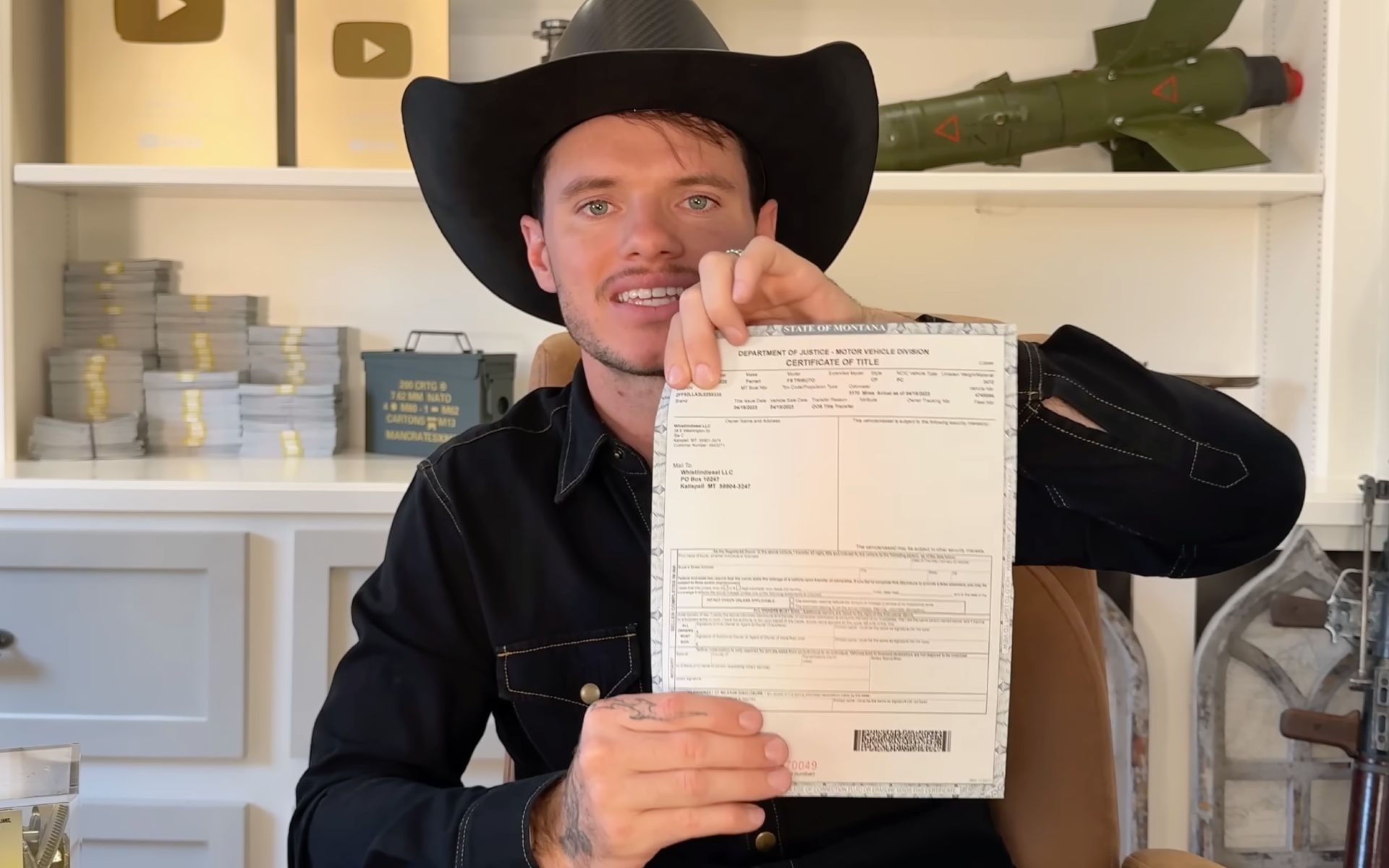

YouTuber Cody “WhistlinDiesel” has revealed that he was arrested for tax evasion, allegedly due to an outstanding sales tax of approximately $30,000 linked to his $400,000 Ferrari F8. On November 23, 2025, he shared details of his arrest in a YouTube video titled “I Got Arrested for ‘Tax Evasion’,” where he elaborated on the circumstances surrounding the incident.

In the video, which spans just over ten minutes, WhistlinDiesel explained that the Ferrari F8, which was involved in a destructive incident in August 2023, was registered in Montana. He noted that Montana does not impose sales tax when assets are registered under a business in the state. This aspect of his vehicle’s registration, he argues, is central to the dispute over tax liability.

Details of the Tax Dispute

During his address to fans, WhistlinDiesel provided insight into why he believes tax authorities pursued him. At the 15-minute mark of the video, he suggested that his ownership of the expensive sports car and the subsequent legal issues stem from a misunderstanding regarding tax obligations in Montana, where he plans to establish a business.

He stated, “I think they went after me because of the car’s value and my public persona.” WhistlinDiesel’s claim emphasizes his belief that the authorities targeted him due to his visibility as a content creator and his high-profile vehicle.

The YouTuber’s situation sheds light on the complexities of tax regulations, especially for high-value assets. As he navigates this challenge, WhistlinDiesel expressed intentions to purchase property in Montana, reinforcing his commitment to establishing a legal business presence in the state.

This incident has sparked discussions among his followers regarding the intersection of tax law and high-value assets, particularly as it pertains to content creators and their financial responsibilities. WhistlinDiesel’s ongoing legal situation serves as a reminder of the potential pitfalls that can arise from asset ownership and tax obligations.

With a substantial following and a penchant for extravagant vehicles, WhistlinDiesel’s experiences resonate with many aspiring entrepreneurs and influencers, highlighting the importance of understanding local tax laws fully. As he moves forward, both his supporters and critics will closely observe how this situation unfolds.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well