Science

India Takes Steps to Boost Rare-Earth Magnet Production Amid Dependency

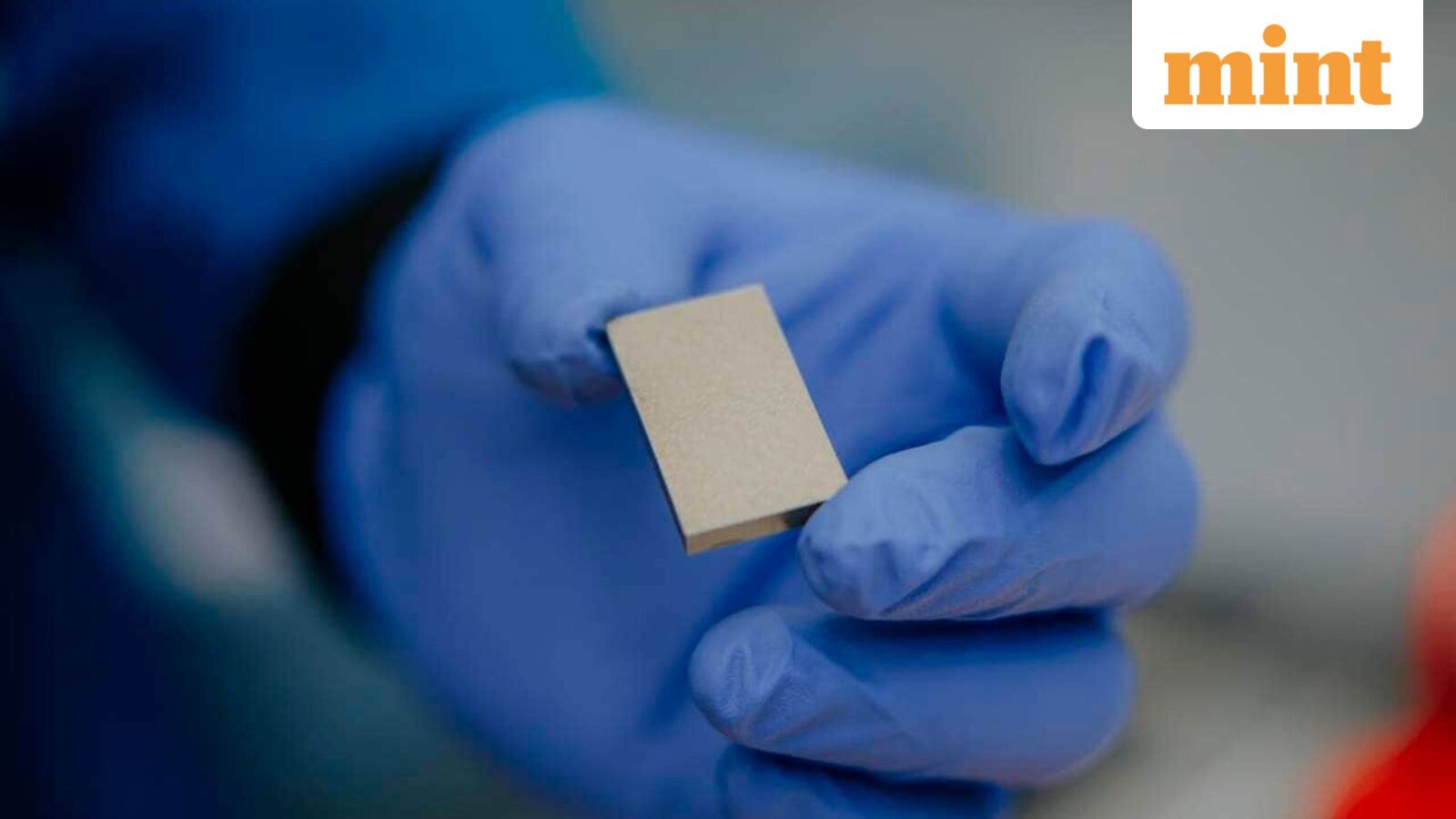

In a significant development for India’s manufacturing landscape, Ashvini Rare Earth has launched the country’s first plant dedicated to producing neodymium-praseodymium (Nd-Pr) metals. These metals are essential for creating permanent magnets used in electric vehicle (EV) motors, wind turbines, and high-end electronic devices. Despite this breakthrough, many of India’s leading EV manufacturers, including Ather and Bajaj Auto, continue to rely on imports from China for their magnet supply. This reliance highlights the complexities of India’s supply chain and the geopolitical realities that complicate domestic production efforts.

The establishment of the Nd-Pr plant in Pune was anticipated to mark a turning point in India’s approach to rare-earth resources. However, the transition from imported Chinese magnets to domestically produced alternatives has not occurred. The reason lies in the advanced nature of sintered NdFeB magnets required for EVs, which differ significantly from the bonded magnets traditionally produced in India. While the launch of the plant signifies progress, India still lacks the commercial-scale capability to produce automotive-grade magnets, leaving manufacturers with no viable choice but to source from China.

China’s dominance in the rare-earth market is not merely a matter of production volume; it stems from decades of government support, scale advantages, and a willingness to absorb environmental costs. Indian companies such as Sona Comstar, Uno Minda, and Mahindra are exploring magnet production lines, yet few have achieved the output necessary to meet the demands of the EV market. Transitioning to a new supplier is not straightforward and entails significant risks, including product redesign and safety testing.

Recent changes in China’s export regulations on heavy rare-earth magnets have further exposed vulnerabilities in India’s supply chain. Ather, Bajaj, and TVS felt the impact of these restrictions, underscoring the importance of diversifying supply sources. The geopolitical landscape has transformed supply chains into instruments of statecraft, with China implementing licensing regimes for critical materials such as gallium, germanium, and graphite.

India’s dependence on Chinese imports is not merely ideological but structural, rooted in years of underinvestment in domestic capability. To address this, experts argue for a comprehensive approach that includes smart fiscal support for local manufacturers. Key areas of focus should be reducing high capital costs related to production, improving yields to achieve automotive standards, and mitigating the risks associated with demand fluctuations.

Potential fiscal strategies could include providing capital expenditure subsidies and long-term low-cost credit to local suppliers. Additionally, incentives should emphasize volume, quality, and reliability rather than just capacity. A successful model could involve demand aggregation across various sectors, including automobiles, electronics, and public sector undertakings, to assure suppliers of consistent demand.

Countries such as the United States, European Union, Japan, and South Korea have already integrated fiscal components into their industrial policies, supporting local production in critical sectors. For instance, the U.S. Chips Act promotes domestic semiconductor and clean energy manufacturing, while the EU is investing in battery technology and raw materials to reduce dependence on single-source supplies.

India’s production-linked incentives echo these global strategies, but the difference between achieving success and merely maintaining the status quo will hinge on capturing the full value of the supply chain. The proposed Rare Earth Permanent Magnet mission could be instrumental in advancing India’s capabilities from merely producing rare-earth metals to establishing a full-scale NdFeB magnet manufacturing sector.

Navigating the geopolitical landscape is equally crucial. India must seek a balanced relationship with China, recognizing it as a significant trading partner while simultaneously working to diversify its supply chains. The goal should be to establish a strategic symbiosis that allows for cooperative trade where dependence is manageable and risks are minimized.

The challenges facing the rare-earth magnet industry are not merely corporate hesitations or a lack of national pride among manufacturers. Companies like Ather and Bajaj are opting for the most reliable options currently available, highlighting the consequences of delayed investments in domestic capacity.

As geopolitical considerations increasingly influence supply chains, India must elevate all critical inputs to the level of strategic infrastructure. Targeted fiscal policies, regulatory clarity, and long-term contracts will be essential to build a robust domestic framework for minerals and technology. The Niti Aayog can play a vital role in identifying strategic challenges and planning countermeasures, ensuring that India is prepared for future vulnerabilities.

Ultimately, significant upfront subsidies for the industry should include provisions for government interests in gross profits, ensuring that the benefits of investment are shared. Success in this sector could transform India from a mere consumer market into a producer of essential materials and technologies in high demand, positioning the country strategically on the global stage.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well