Lifestyle

Charitable Organizations Must File Audit Reports; New Rules Enforced

Charitable organizations in India with an annual income exceeding ₹5 crore are now mandated to file audit reports using Form 10B. This requirement applies to trusts registered under Section 12-A or Section 10(23C) of the Income Tax Act, particularly if they have received foreign contributions. The audit reports must be submitted on the income tax portal by October 31 each year.

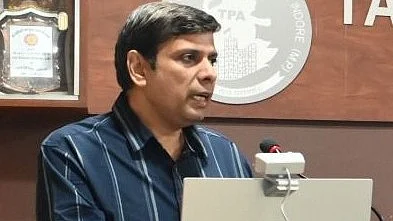

During a seminar held on October 27, 2023, organized by the Tax Practitioners’ Association and the Indore branch of the Chartered Accountants (CA), CA Bhagwan Agarwal outlined the expectations for these organizations. He emphasized that taxpayers need to detail their primary business activities, total revenue, and expenditures for the financial year, ensuring that funds are allocated appropriately to the trust’s objectives.

Organizations must ensure that no more than 15% of their total income is retained as profit reserves, meaning at least 85% of their income should be directed towards charitable activities. Additionally, audit reports must include specifics regarding investments in funds or assets, income and expenditure accounts, donations, and any transfers to other trusts. Importantly, all anonymous donations received in the previous financial year must also be disclosed in the Income Tax Return (ITR).

CA Agarwal noted that these audit reports can be complex and require meticulous preparation. He warned that any small oversight could lead to a notice from the income tax department, highlighting the increased scrutiny on charitable organizations. This action aims to combat fraudulent entities that attempt to evade taxes by falsely claiming exemptions.

In support of these new measures, CA JP Saraf, president of the Tax Practitioners’ Association, reiterated that the government has intensified its oversight of charitable organizations’ taxation in recent years. He stated that these reforms are crucial in diminishing the prevalence of fraudulent organizations that exploit loopholes in the tax system.

As the deadline for filing these reports approaches, it is vital for charitable organizations to comply fully with the new regulations to avoid penalties and ensure transparency in their financial dealings.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well