Business

Titan Shares Surge for Eighth Week, Adding ₹51,212 Crore in Value

Investors continue to show confidence in the Titan Company, part of the Tata Group, as its share price has risen for eight consecutive weeks. This marks the company’s longest winning streak in recent history. On the latest trading day, the stock closed at ₹ 3,904, reflecting a 2% increase and pushing its cumulative gains over the eight-week period to 17.4%. During this time, Titan shares reached a new record high of ₹ 3,956 apiece.

The uninterrupted upward trend has led to a remarkable addition of ₹ 51,212 crore to Titan’s market capitalisation, which now stands at ₹ 3.46 lakh crore. This positions Titan as one of the most valued firms among Tata Group companies. Following a period of selling pressure in September, the company’s stock reversed direction in October, gaining momentum after the announcement of its Q2FY26 financial results. Analysts have responded positively, maintaining an optimistic outlook for Titan.

Despite rising gold prices that are anticipated to deliver the strongest yearly performance for the metal, Titan’s Q2 numbers exceeded analysts’ expectations. Market sentiment remains upbeat for the second half of FY26, particularly with the ongoing wedding season expected to drive sales even as gold prices remain elevated.

Strong Financial Performance in Q2FY26

For the quarter ending September, Titan reported a substantial 59% year-on-year increase in consolidated net profit, amounting to ₹ 1,120 crore. This growth was supported by robust performance across various segments. The company’s consolidated revenue from operations reached ₹ 16,649 crore, a 22% rise from ₹ 13,661 crore in the same period last year.

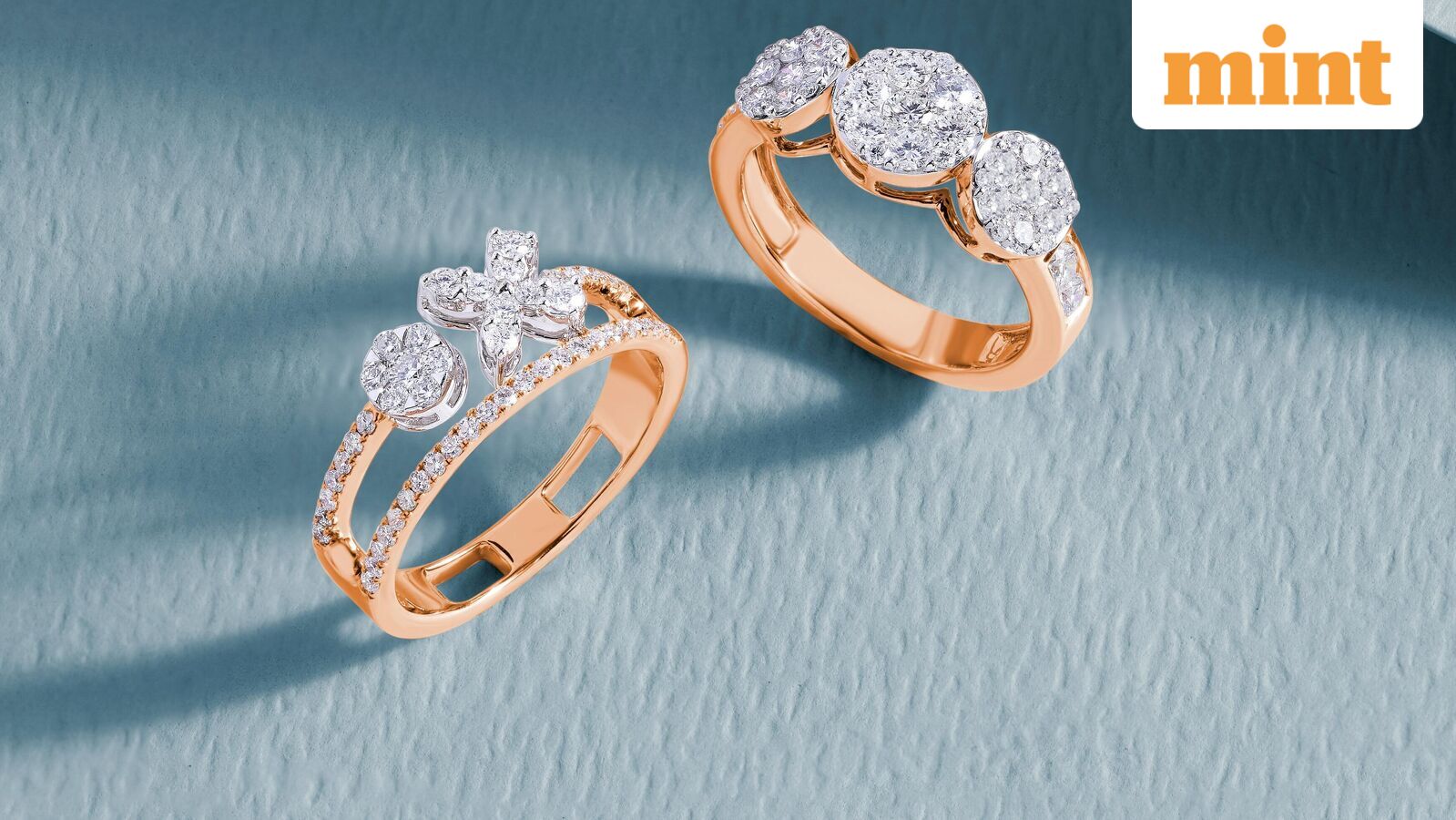

The jewellery segment, which contributes over 80% of Titan’s revenue, saw a 21% increase year-on-year, reaching ₹ 14,092 crore (excluding bullion and digi-gold sales). Notably, Titan’s branded jewellery lines, including Tanishq, Mia, and Zoya, collectively reported an 18% year-on-year growth, contributing ₹ 12,640 crore. Additionally, CaratLane achieved an impressive 32% increase, generating ₹ 1,072 crore during the same period.

In a strategic move to expand its footprint, Titan announced plans to acquire a controlling stake in Damas Jewellery, a prominent brand in the Gulf Cooperation Council (GCC) member countries.

Investor Confidence and Market Trends

Over the past nine years, including 2025, Titan’s stock has closed positively in eight of those years, with only 2024 witnessing a decline of 11.5%. This consistent performance has resulted in a staggering return of nearly 1,100%, significantly enhancing the wealth of long-term investors who have trusted the company’s business fundamentals.

As of the latest quarter, retail shareholders collectively hold a 16.8% stake in Titan, while mutual funds own 7.84% of this Tata Group firm.

As investors navigate the complexities of the market, it is advisable to consult with certified experts before making any investment decisions. The information provided is for educational purposes and reflects the views of individual analysts or broking companies, not necessarily representing Mint’s stance on the matter.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well