Business

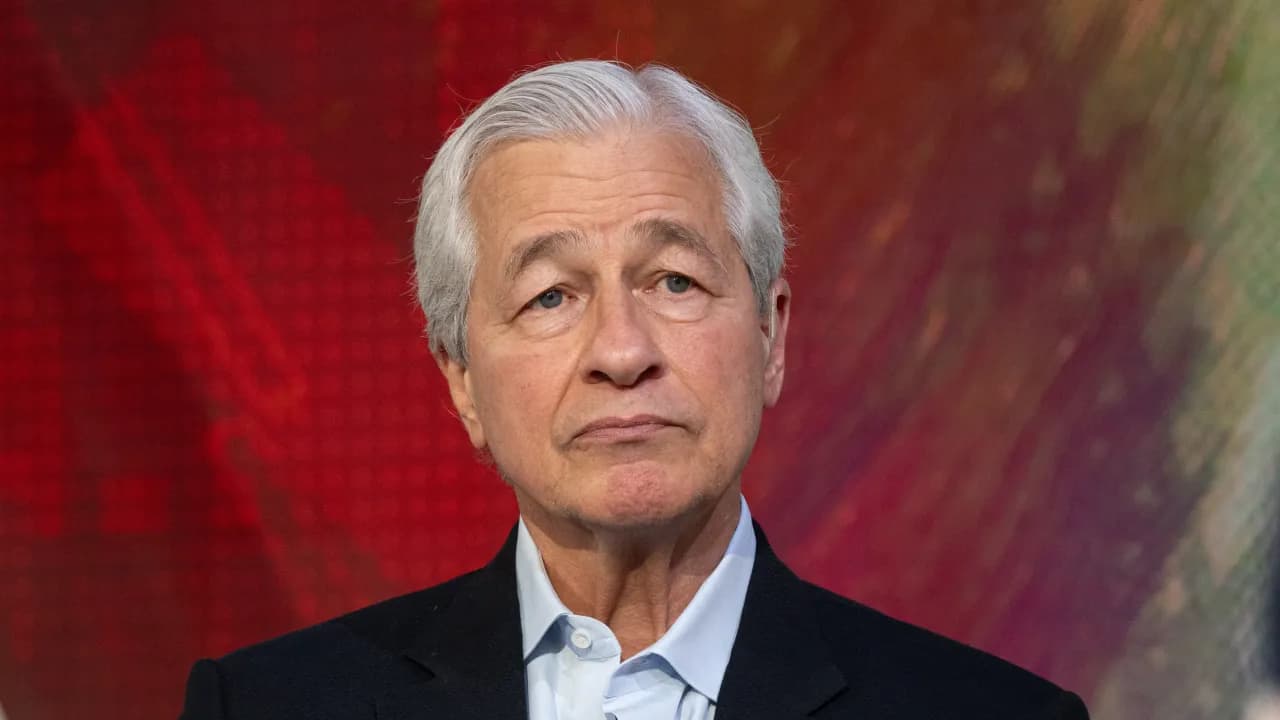

Jamie Dimon Flags Excess in Corporate Lending Amid Auto Bankruptcies

Jamie Dimon, CEO of JPMorgan Chase & Co., has indicated that there are “early signs” of excess in corporate lending within the United States. This assessment comes in light of recent bankruptcies in the auto industry, specifically the collapse of auto parts company First Brands and car lender Tricolor Holdings. Dimon made these remarks during a press conference following the bank’s third-quarter results on October 17, 2023, as reported by CNBC.

Dimon emphasized the implications of these bankruptcies, stating, “These are early signs there might be some excess out there because of it. If we ever have a downturn, you’re going to see quite a bit more credit issues.” He noted that the credit environment has largely been favorable since 2010 or 2012, suggesting that a shift could be on the horizon.

The auto sector has faced significant challenges recently, leading to increased scrutiny of lending practices. The failures of First Brands and Tricolor Holdings highlight potential vulnerabilities in the market. Dimon’s comments suggest that investors and stakeholders should remain vigilant about the state of corporate lending, particularly as economic conditions may change.

On the day of Dimon’s statements, shares of JPMorgan experienced a decline of nearly 3% in early trading. Despite this, retail sentiment towards the bank on Stocktwits remained in the “extremely bullish” range, indicating a complex view among investors.

As the banking sector navigates these early warning signs, analysts will be closely monitoring developments in corporate lending and the broader economic landscape. The implications of Dimon’s observations may resonate beyond the auto industry, prompting discussions about lending practices across various sectors.

In summary, the remarks from Dimon signal a cautious outlook on corporate lending dynamics, particularly in the context of recent high-profile bankruptcies. The financial community will likely be on high alert as the situation evolves, with particular attention paid to credit risk and market stability.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well