Business

PM Modi Launches GST Utsav, Promises Savings for Millions

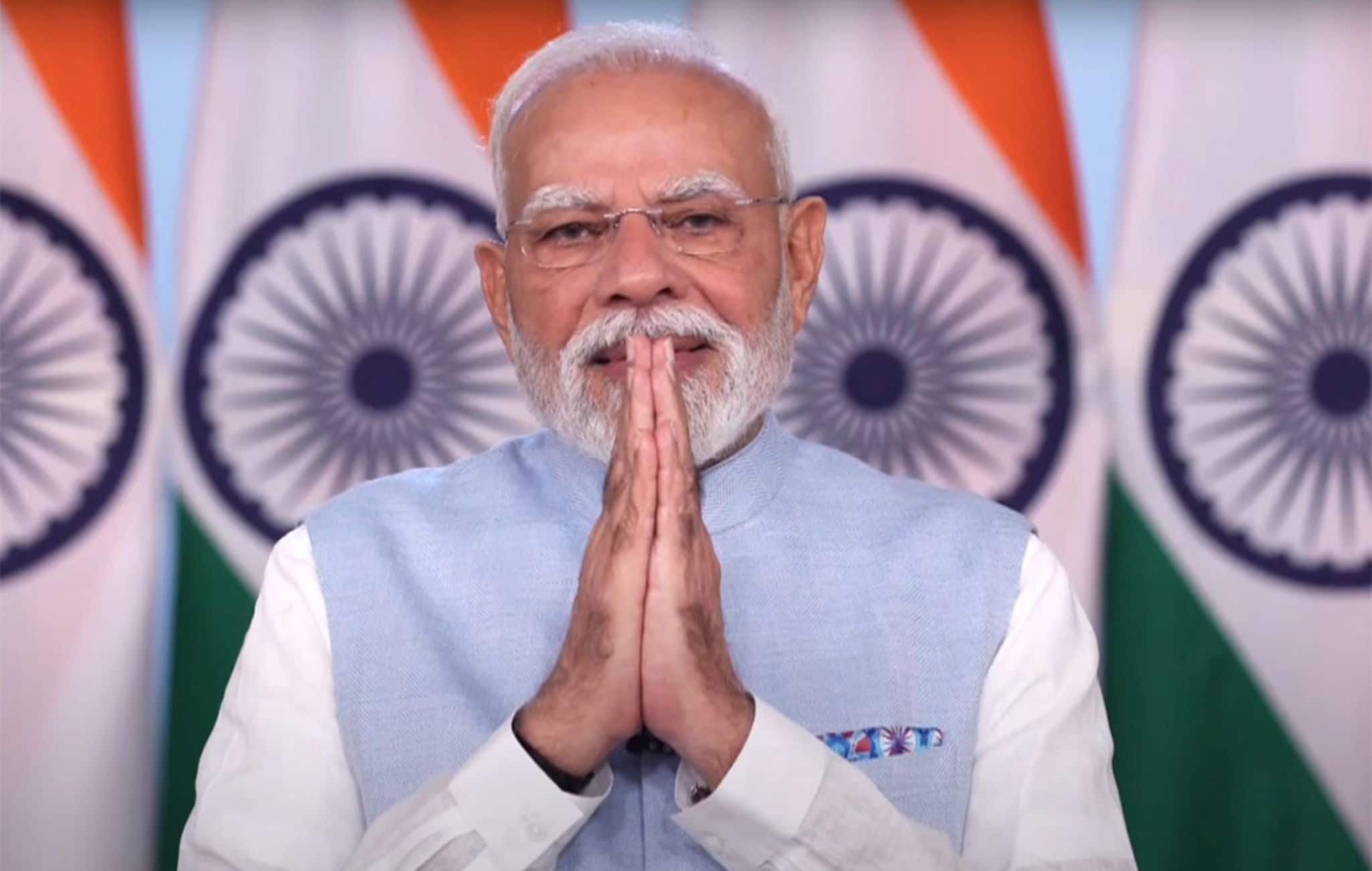

Prime Minister Narendra Modi addressed the nation on September 17, 2023, announcing the launch of a “GST Utsav” to coincide with the start of the Navratri festival. This initiative aims to promote savings for Indian consumers by implementing new Goods and Services Tax (GST) rates beginning on September 22. The Prime Minister described the event as a festival of savings, particularly benefiting the poor and the emerging middle class.

Key Features of the GST Utsav

The GST Utsav introduces what Modi termed “next-generation GST reforms,” which will simplify the purchasing process for Indian consumers. He stated, “From tomorrow, you will be able to buy your favourite items with ease. This is like a GST saving festival for every Indian.” The new GST structure will primarily consist of two tax slabs: 5% and 18%. Many essential items, including food, medicines, and daily household goods, will see reduced tax rates, with an estimated 99% of items previously taxed at 12% now falling under the 5% tax category.

Modi emphasized that these reforms are designed to directly benefit various demographics, including farmers, micro, small, and medium enterprises (MSMEs), middle-class families, women, and youth. He noted that the simplification of tax regulations will alleviate financial burdens for these groups.

Reflections on Past Challenges

In his address, Modi reflected on the economic challenges faced by Indian businesses prior to the introduction of GST in July 2017. He recounted an anecdote from 2014, highlighting the complexities of transporting goods across states. “A company said that if it had to send its goods from Bengaluru to Hyderabad, it was so difficult that they would prefer to send their goods to Europe first,” he explained. This situation underscored the urgent need for reform, aimed at reducing logistical costs and enhancing business operations.

Modi reiterated the necessity of ongoing reforms, stating, “Reform is a continuous process. As times change and the country’s needs change, next-generation reforms are equally necessary.” He expressed confidence that the latest GST changes align with both current demands and future aspirations for India’s economy.

The Prime Minister also underscored the importance of self-reliance in achieving national goals. He urged citizens to support the local economy by purchasing more Indian-made products, linking this initiative to the broader vision of Atmanirbhar Bharat (Self-Reliant India). “What is needed by the people of the country, what we can make in our own country, we should make right here,” he stated.

Modi encouraged state governments to participate in this movement by fostering an investment-friendly environment and increasing production. He believes that collaboration between the central government and state administrations will be crucial in realizing the dream of an Atmanirbhar Bharat.

The recent GST reforms represent the most significant overhaul of India’s indirect tax system since GST’s initial launch. The changes, announced on September 4, are designed to facilitate smoother transactions and reduce the financial burden on consumers. According to IANS, the restructured system includes a tax rate of 40% for luxury and demerit goods, further simplifying the tax landscape for most everyday products.

As the GST Utsav unfolds, the Indian government aims to create a more equitable economic environment, ensuring that the benefits of these reforms reach all sections of society. The Prime Minister’s message resonates with the hope that these changes will empower millions of Indians while fostering a spirit of self-reliance and national pride in domestic production.

-

World5 months ago

World5 months agoSBI Announces QIP Floor Price at ₹811.05 Per Share

-

Lifestyle5 months ago

Lifestyle5 months agoCept Unveils ₹3.1 Crore Urban Mobility Plan for Sustainable Growth

-

Science4 months ago

Science4 months agoNew Blood Group Discovered in South Indian Woman at Rotary Centre

-

World5 months ago

World5 months agoTorrential Rains Cause Flash Flooding in New York and New Jersey

-

Top Stories5 months ago

Top Stories5 months agoKonkani Cultural Organisation to Host Pearl Jubilee in Abu Dhabi

-

Sports4 months ago

Sports4 months agoBroad Advocates for Bowling Change Ahead of Final Test Against India

-

Science5 months ago

Science5 months agoNothing Headphone 1 Review: A Bold Contender in Audio Design

-

Top Stories5 months ago

Top Stories5 months agoAir India Crash Investigation Highlights Boeing Fuel Switch Concerns

-

Business5 months ago

Business5 months agoIndian Stock Market Rebounds: Sensex and Nifty Rise After Four-Day Decline

-

Sports4 months ago

Sports4 months agoCristian Totti Retires at 19: Pressure of Fame Takes Toll

-

Politics5 months ago

Politics5 months agoAbandoned Doberman Finds New Home After Journey to Prague

-

Top Stories5 months ago

Top Stories5 months agoPatna Bank Manager Abhishek Varun Found Dead in Well